Filed under Home Insurance on

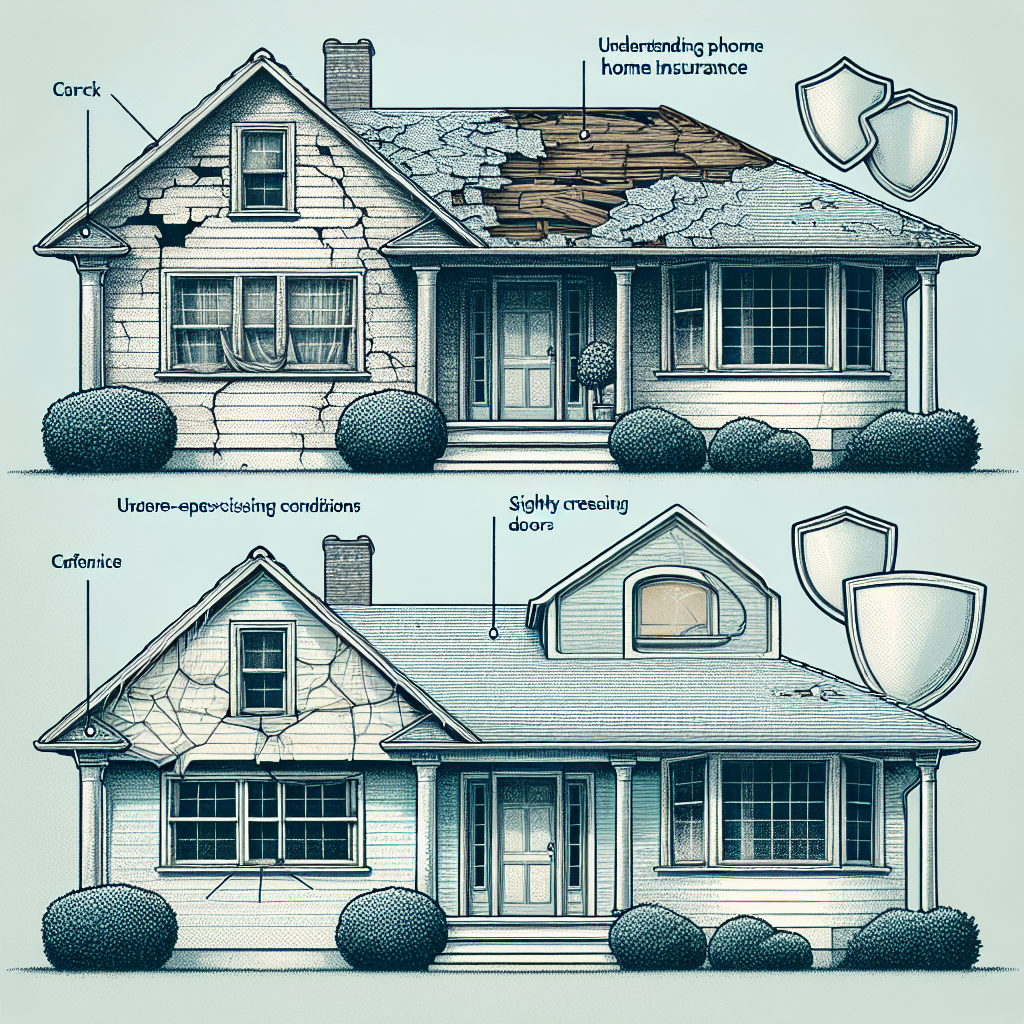

Understanding Pre-Existing Conditions in Home Insurance

When navigating the complex landscape of home insurance, understanding the nuances of pre-existing conditions can arm you with the knowledge needed to make informed decisions. Homeowners need to be aware of how these pre-existing conditions can affect coverage, premiums, and ultimately, claims. This article delves into what pre-existing conditions in home insurance entail, why they matter, and how homeowners can best manage them.

Defining Pre-Existing Conditions in Home Insurance

Pre-existing conditions refer to damages or issues with a property that existed before obtaining a new home insurance policy. Unlike health insurance where the term often applies to medical histories, in home insurance, it relates to the physical state of your home before you start a new coverage period. This could include structural damage, wear and tear, or ongoing issues like mold or pest infestations.

Why Insurers Care About Pre-Existing Conditions

Insurers evaluate properties for pre-existing conditions to assess risk accurately. Underwriting guidelines often demand a comprehensive understanding of a home's current state to price coverage appropriately. If a home has significant undiagnosed issues, it may pose a higher risk for future claims, influencing both the availability and cost of insurance.

Common Pre-Existing Conditions to Watch For

- Structural Damage: Cracks in the foundation or walls are a red flag.

- Roof Integrity: Missing shingles or visible leaks are critical indicators.

- Water Damage: Stains, dampness, or mold growth often suggest underlying problems.

- Electrical Issues: Outdated or faulty wiring can pose significant risks.

- Pest Infestation: Termite damage or rodent infestations need attention.

How Pre-Existing Conditions Influence Insurance Policies

Pre-existing conditions can have a notable impact on home insurance policies, altering premiums or even leading to coverage denial. Understanding this aspect is crucial for any homeowner seeking adequate protection without overpaying.

Impact on Premiums

Insurance providers may increase premiums if they identify extensive pre-existing conditions. This increase reflects the higher associated risk of potential claims. Homeowners with numerous or severe issues might face higher costs due to the insurer’s anticipation of future repairs or losses.

Coverage Limitations and Exclusions

Policies sometimes exclude coverage for pre-existing conditions identified during initial assessments. For instance, if a roof is already compromised, an insurer may exclude future damage repairs stemming from this issue, reinforcing the importance of resolving such problems before seeking new coverage.

Potential for Claim Denial

Claims related to pre-existing conditions are often denied if they weren’t disclosed or rectified before the policy was in effect. Understanding this potential roadblock helps homeowners prepare adequately and avoid unpleasant surprises during the claims process.

Strategies for Dealing with Pre-Existing Conditions

While pre-existing conditions are common, there are effective strategies allowing homeowners to successfully navigate these challenges. Proactively addressing and documenting these issues can aid significantly in managing insurance outcomes.

Conducting a Thorough Home Inspection

A professional home inspection is paramount before purchasing or renewing insurance. Inspectors can identify and document any pre-existing conditions that should be addressed, helping homeowners rectify them before obtaining a new policy. This preventive measure ensures transparency and aids in securing equitable coverage.

Making Necessary Repairs

Addressing known pre-existing conditions can demonstrate responsibility and reduce risk, potentially leading to lower premiums. Repairing or upgrading problematic areas not only enhances safety and comfort but also increases bargaining power with insurers.

Transparent Communication with Insurers

Openly communicating any pre-existing conditions with insurers fosters trust and creates a clearer picture of the risk landscape. This transparency can aid in securing more favorable terms while avoiding issues that could complicate future claims.

Industry Trends and the Future of Pre-Existing Condition Considerations

The home insurance sector continually evolves, reflecting broader changes in the housing market and advancements in technology. Understanding current trends can offer insights into managing pre-existing conditions in the future.

The Role of Technology

Technological advancements, such as smart home devices and IoT (Internet of Things), enable real-time monitoring of home conditions, potentially reducing the need for guesswork regarding pre-existing issues. This tech aids in early detection of problems, fostering more robust prevention strategies.

Shifts in Underwriting Practices

Insurers increasingly use data analytics to enhance underwriting practices, integrating more variables than ever before to assess property risks. Understanding this shift can empower homeowners to engage proactively with insurers to secure coverage reflecting accurate property conditions.

Emphasis on Preventive Measures

Insurers may reward preventive measures more than ever, with discounts or favorable terms for homes employing advanced safety and maintenance systems. Implementing such initiatives can mitigate risks associated with pre-existing conditions and possibly lead to cost-saving opportunities.

Conclusion: Navigating Pre-Existing Conditions with Confidence

Understanding the ramifications of pre-existing conditions on home insurance equips homeowners with the strategic advantage needed to navigate insurance options wisely. By conducting thorough inspections, addressing existing issues, and fostering clear communication with insurers, homeowners can secure comprehensive coverage tailored to their needs.

Armed with knowledge and a proactive approach, dealing with pre-existing conditions does not have to be daunting. By staying informed about insurance industry trends and incorporating preventive measures, you can mitigate risks and ensure that your home, whether new or aging gracefully, remains well-protected against unexpected damages.