Filed under Home Insurance on

Does Home Insurance Include Ductwork Coverage?

Home insurance is a critical component of protecting one’s largest investment: their residence. However, the specifics of what home insurance covers can sometimes be perplexing. Among the various potential queries homeowners may have is “Does home insurance include ductwork coverage?” This question is vital, especially when considering the essential role ductwork plays in heating, ventilation, and air conditioning (HVAC) systems. This article will dive into the intricate world of home insurance, focusing on whether it includes coverage for ductwork.

Understanding Home Insurance Basics

To comprehend if home insurance includes ductwork coverage, it's essential first to understand the general scope of home insurance policies. Typically, homeowners insurance, also known as property insurance, is designed to cover damage to the structure of your home and the belongings inside due to covered perils. These perils might include fire, theft, vandalism, and certain natural disasters.

Home insurance policies generally fall into several different types, which offer varying levels of coverage. The most common type is the HO-3 policy, which covers the building structure, personal property, liability, loss of use, and, in some cases, medical payments to others. However, damage caused by unavoidable wear and tear, negligence, or maintenance issues is usually not covered.

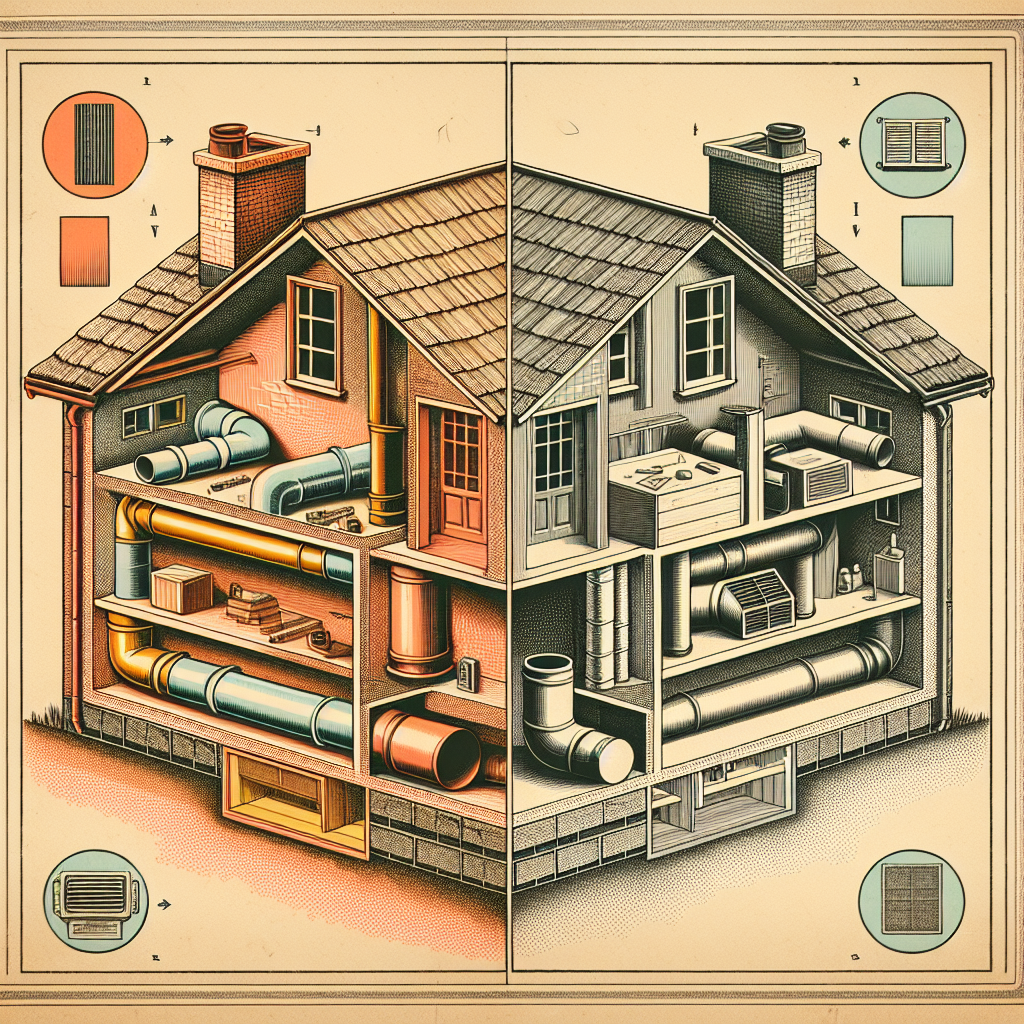

The Role of Ductwork in Your Home

Ductwork is an integral part of a home's HVAC system, responsible for distributing heating and cooling throughout the home. Properly functioning ductwork ensures efficient temperature regulation, contributing to both comfort and energy savings.

Given its vital role, any damage to the ductwork can lead to a range of problems, from inefficient heating and cooling to increased utility bills, and can even impact air quality. Therefore, understanding whether your home insurance includes ductwork coverage is crucial for maintaining the well-being of your home and its occupants.

Does Home Insurance Include Ductwork Coverage?

The answer to whether home insurance includes ductwork coverage is nuanced and generally depends on the specific terms of your policy and the cause of the ductwork damage. Ductwork can potentially be covered under your home insurance policy, but this typically hinges on the damage arising from a covered peril.

Covered Perils

Home insurance policies usually cover ductwork damage resulting from specific perils. For instance, if a covered peril like a fire or a sudden and accidental event like a burst pipe damages your ductwork, your insurance might help cover the repair or replacement costs.

Maintenance and Wear and Tear

Conversely, if your ductwork issues stem from general wear and tear or a lack of maintenance, these are typically not covered by standard home insurance policies. Insurers expect homeowners to maintain their homes, which includes routine inspection and upkeep of the ductwork.

Exclusions and Special Policies

It is also important to review your policy for any exclusions that may apply. Depending on your insurance provider, you might need to purchase an endorsement or additional coverage specifically for ductwork or related systems. Consult your insurance agent to understand the specific coverage you need based on your home's layout and existing systems.

Steps to Take If Your Ductwork Is Damaged

If you find yourself with damaged ductwork, the first step is to assess the damage and determine the likely cause. This assessment can guide your next actions, whether it involves filing an insurance claim or arranging for repairs.

File a Claim

If the damage resulted from a covered peril, you should contact your insurance company as soon as possible to report the claim. Provide them with documented evidence of the damage and any estimates for repairs required.

Professional Support

Hiring a professional to inspect your ductwork and provide a repair estimate can offer a clearer picture of the necessary work. This report might be required by your insurance company to verify the claim and process any reimbursement or payments.

Industry Trends and Developments

It’s crucial to remain informed about industry trends concerning home insurance and ductwork. Recent years have seen a rise in personalized insurance policies, which means homeowners can tailor coverage to better suit their needs, including specific components like ductwork.

Additionally, technological advancements in HVAC systems are prompting insurance companies to adapt, potentially offering new types of policies or endorsements to cover these emerging features and systems.

Consulting Experts and Reviewing Policies

Regularly revisiting your insurance policy with a professional ensures that you have adequate ductwork coverage. An expert can help decipher policy language and recommend any additional coverage that might be beneficial, ultimately safeguarding your home from unexpected expenses.

Final Thoughts

Understanding home insurance, especially concerning ductwork coverage, is essential for any homeowner relying on a smoothly functioning HVAC system for comfort and efficiency. While ductwork may not be directly mentioned in basic home insurance policies, damage from certain covered perils could be included. Consistent maintenance and an understanding of your policy provisions will protect your investment and ensure your home remains a safe haven. For specific queries, liaising with your insurance agent will provide clarity and peace of mind.

In conclusion, while standard home insurance may not always automatically cover ductwork, with the right knowledge and policy amendments, homeowners can achieve comprehensive coverage to encompass their essential home systems.