Filed under Health Insurance on

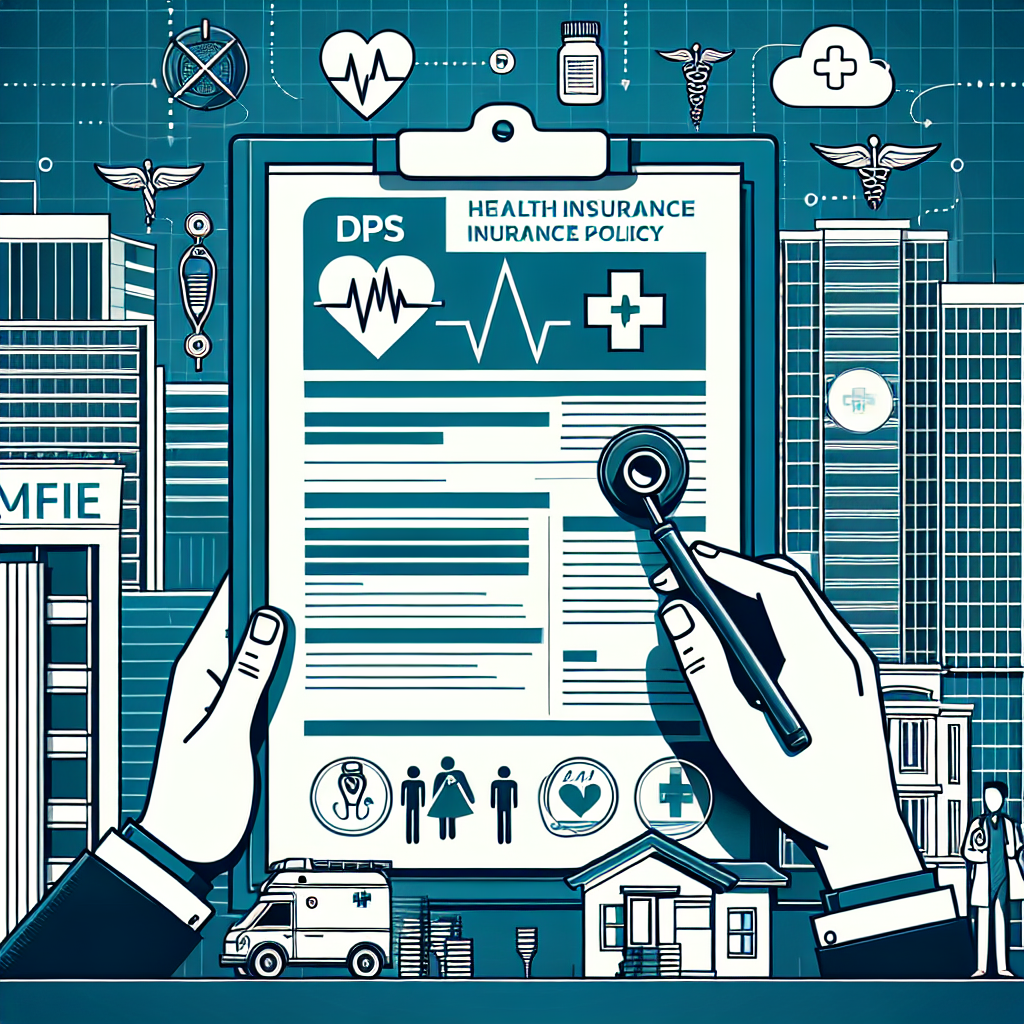

Understanding DPS Health Insurance: A Comprehensive Guide

In today's fast-paced world, understanding the intricacies of health insurance can feel daunting. Yet, it's a crucial part of ensuring both financial stability and access to necessary healthcare. Among various options available, DPS health insurance emerges as a noteworthy choice for many. This comprehensive guide will walk you through everything you need to know about DPS health insurance, equipping you with the knowledge to make informed decisions.

What is DPS Health Insurance?

DPS health insurance is a specialized health insurance plan designed to meet diverse healthcare needs. The plan is primarily structured to support individuals, families, and sometimes, a network of organizations seeking a reliable health coverage option. Whether you're new to the concept or considering switching your current plan, understanding DPS health insurance is essential.

Core Features of DPS Health Insurance

- Diverse Coverage Options: DPS health insurance offers a broad spectrum of coverage options, catering to various medical needs and preferences.

- Affordability: Cost-effectiveness is a hallmark of DPS health insurance, allowing policyholders to access quality healthcare services without breaking the bank.

- Comprehensive Benefits: DPS health insurance policies often include preventive care, emergency services, hospitalization, and prescription medications.

- Flexibility: Many DPS health insurance plans provide flexibility in choosing healthcare providers and facilities.

Why Choose DPS Health Insurance?

Choosing the right health insurance plan is a significant decision. DPS health insurance has gained popularity for several reasons:

- Tailored Plans: DPS health insurance offers a wide range of plans tailored to suit different demographics and life stages, from young singles to large families.

- Network of Providers: Subscribers enjoy an extensive network of healthcare providers, ensuring quality care wherever they are.

- Customer Support: Known for strong customer service, DPS health insurance delivers excellent support, assisting with queries and claims efficiently.

- Innovative Solutions: The company frequently updates its plans to incorporate innovative healthcare solutions and treatments to provide the best possible coverage.

How DPS Health Insurance Compares

When evaluating health insurance options, it’s vital to compare features, costs, and coverage. Here’s how DPS health insurance stands out:

Comparative Analysis

- Cost-Benefit Balance: DPS health insurance provides a balance between premium costs and the range of benefits, often surpassing competitors in value.

- Customer Satisfaction: High customer satisfaction ratings and positive feedback highlight DPS health insurance as a top choice for many.

- Claim Processing: Efficient and straightforward claim processing is a considerable advantage, reducing stress for policyholders.

Understanding the Types of DPS Health Insurance Plans

DPS health insurance plans come in several forms, each designed for different needs and circumstances. Here’s a breakdown of the primary plan types:

Individual Plans

These plans cater to singles or individuals without dependents. They cover an array of services, including doctor visits, preventive care, and prescriptions.

Family Plans

Family plans encompass coverage for families, including medical, dental, and vision care, ensuring each member's health needs are attended to.

Employer-Sponsored Plans

Many organizations offer DPS health insurance as part of their employee benefits, providing comprehensive coverage that often includes perks like wellness programs.

Specialized Coverage Plans

- Chronic Condition Plans: Designed for those with long-term health conditions, these plans often include specialized treatment and medication coverage.

- Maternity Plans: Tailored to cater to maternity care, covering prenatal, delivery, and postnatal services.

How to Enroll in DPS Health Insurance

Enrolling in a DPS health insurance plan is a straightforward process, but it requires some thoughtful consideration. Follow these steps to ensure seamless enrollment:

- Assess Your Needs: Begin by evaluating your healthcare needs and financial situation. Consider factors like family size, medical history, and budget.

- Research Plans: Investigate various DPS health insurance plans, comparing coverage, costs, and benefits.

- Speak with an Advisor: Contact a DPS health insurance advisor to clarify doubts, and get professional guidance tailored to your situation.

- Submit Application: Once you’ve chosen a plan, complete and submit your application either online or through a DPS representative.

- Review Policy Details: Upon acceptance, thoroughly review your policy details to understand terms, benefits, exclusions, and claims process.

Tips for Maximizing Your DPS Health Insurance Benefits

After your DPS health insurance plan is in place, consider these strategies to maximize your benefits and get the most out of your coverage:

- Preventive Care Utilization: Take advantage of preventive services offered, such as annual check-ups and vaccinations, which are often covered fully.

- Stay In-Network: To reduce out-of-pocket expenses, choose healthcare providers within the DPS health insurance network.

- Understand Your Plan: Familiarize yourself with the specifics of your plan, including copayments, deductibles, and coverage limits.

- Regular Updates: Stay informed about any changes or updates in coverage that may affect your plan.

Addressing Common Concerns About DPS Health Insurance

As with any health insurance plan, potential subscribers may have questions or concerns. Here are some common queries addressed:

Frequently Asked Questions

- What if I need specialized care? DPS health insurance includes options for coverage of specialized and complex medical needs.

- How are emergencies handled? Emergency care is typically covered comprehensively, ensuring access to urgent medical assistance.

- Can I switch plans? Yes, plan adjustments can be made annually or during specific qualifying events.

The Future of DPS Health Insurance

DPS health insurance continually evolves to meet the changing healthcare landscape. With advancements in technology and treatment methods, DPS adapts by integrating innovative healthcare solutions and maintaining competitive benefits. Observing industry trends, DPS health insurance is poised to remain a leader, providing flexible and comprehensive plans tailored to the modern policyholder's needs.

In conclusion, understanding DPS health insurance requires an exploration of its features, benefits, and strategic plan options. Whether you're evaluating individual, family, or employee-sponsored plans, DPS health insurance offers an extensive array of benefits designed to meet diverse healthcare demands. Armed with this guide, you can confidently navigate your health insurance choices and select the plan that best supports your health and financial well-being.