Filed under Health Insurance on

How to Add Your Spouse to Blue Cross Health Insurance

When it comes to managing your family's health care, understanding how to add your spouse to Blue Cross health insurance is paramount. Whether you’re newly married or ready for a change in your existing plan, ensuring your spouse is covered under your health policy requires careful attention and timely action. This guide breaks down each step, offering clarity and easing any stress associated with the process.

Assessing Your Current Blue Cross Health Plan

Before diving into the specifics of adding a spouse, it's crucial to assess your existing Blue Cross health insurance plan. Start by examining the details: coverage limits, monthly premiums, deductibles, and any out-of-pocket costs. Understanding these elements will help you determine how adding a spouse might impact your plan's financial and coverage aspects.

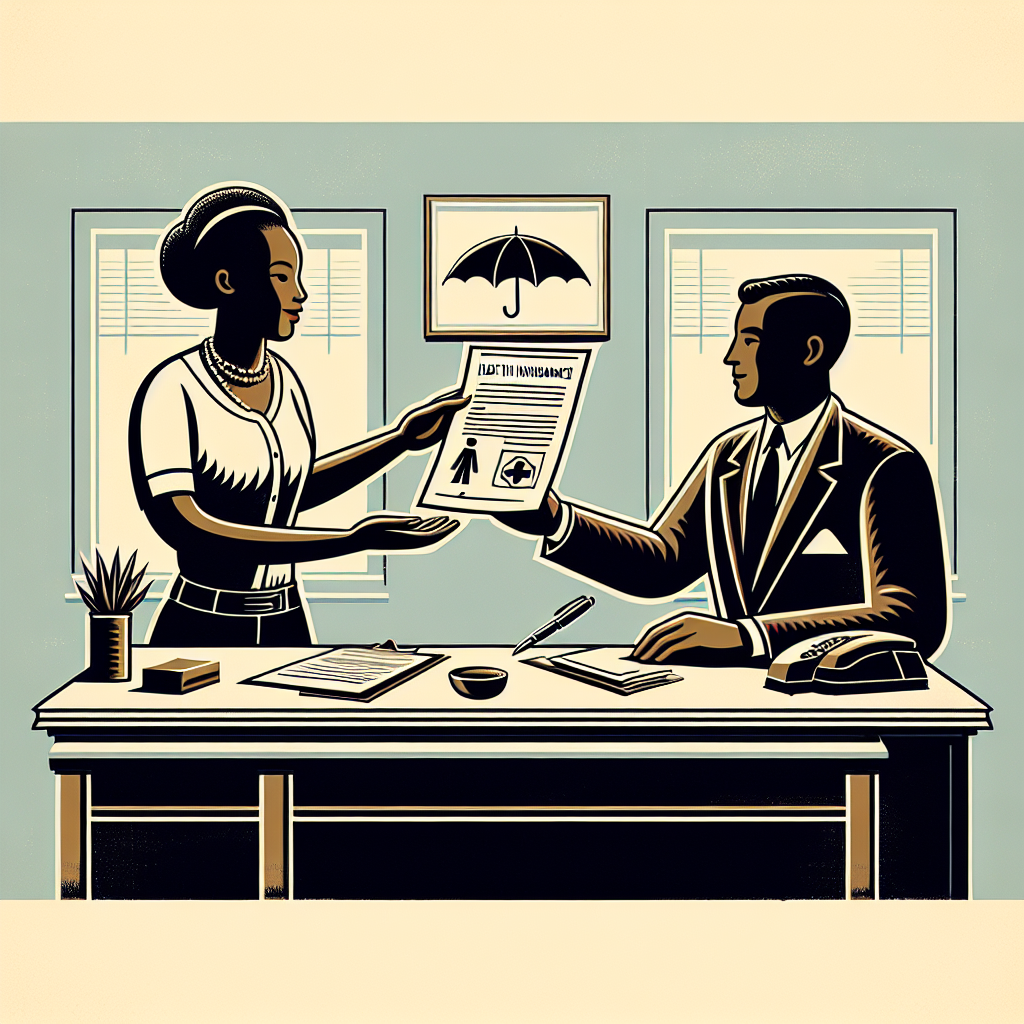

Check the Eligibility Requirements

Every insurance provider, including Blue Cross, has specific eligibility criteria for adding dependents, including spouses. To add your spouse to Blue Cross health insurance, you’ll need to present evidence of a legitimate marital relationship. Typically, this involves providing a marriage certificate alongside completing any required forms requested by the insurance company.

Review Special Enrollment Periods

Outside the open enrollment window, most insurance plans allow for changes during a special enrollment period (SEP). Life events such as marriage qualify you for this period. Understanding the timeline for your SEP is vital because it affects when your spouse's coverage will commence under Blue Cross health insurance. Missing the SEP can delay your spouse's addition until the next official enrollment period.

Understanding Plan Options and Coverage

When adding your spouse to Blue Cross health insurance, it’s the perfect opportunity to evaluate different plan options available. Consider factors such as existing health needs and preferred healthcare providers to ensure the plan matches your family's requirements.

Individual vs. Family Plans

If you’re currently on an individual plan, switching to a family plan may be more beneficial after adding your spouse. Family plans typically offer more comprehensive coverage suitable for families, potentially reducing overall costs when compared to maintaining separate individual policies.

Coverage Level Comparison

Alongside switching to a family plan, examine the coverage levels offered by various Blue Cross plans. These plans often vary in terms of premiums and out-of-pocket expenses. It’s prudent to balance monthly costs with the potential need for health services throughout the year to find a plan suitable for both you and your spouse.

Steps to Add Your Spouse to Blue Cross Health Insurance

Securing your spouse's health insurance under your Blue Cross policy involves several key steps, detailed below:

Gather Necessary Documentation

- Marriage Certificate: A copy of your marriage certificate is often required to validate your spousal relationship.

- Identification: Provide government-issued identification for both you and your spouse.

- Completed Application Forms: Blue Cross may require specific enrollment or amendment forms to be completed and signed.

Contact Blue Cross Customer Service

Reach out to Blue Cross either through their customer service line or via their online portal. Customer service representatives can guide you through the necessary procedures and inform you of any additional paperwork or steps required to add a spouse to Blue Cross health insurance.

Complete the Enrollment Process

Once you’ve gathered your documentation, filled out the necessary forms, and contacted Blue Cross, you’ll submit everything through the appropriate channels. Follow up if necessary to confirm your spouse's successful addition to your health insurance plan.

Financial Considerations and Budget Planning

Adding a spouse to your Blue Cross health insurance plan can impact your healthcare budget significantly. Thus, having a clear financial strategy is critical.

Budget for Increased Premiums

Expect your monthly premiums to rise once you add your spouse to Blue Cross health insurance. Use the plan comparison options provided by Blue Cross to choose a plan that fits comfortably within your budget without compromising necessary coverage.

Evaluate Out-of-Pocket Expenses

Out-of-pocket costs, which include deductibles and copays, can also shift significantly. Ensure that any new plan accommodates your and your spouse’s medical needs without leading to unexpected financial stress.

Benefits of Adding Your Spouse to Health Insurance

While entwining your insurance with your spouse seems like another chore, the benefits often justify the process.

Family Coverage and Simplicity

A single insurance policy for both yourself and your spouse means all healthcare services and transactions are streamlined under one account. This consolidation can simplify payment processes and record-keeping, making comprehensive management of health expenses easier.

Potential Cost Savings

Switching to a combined family plan often results in lower overall premiums compared to managing separate plans. Additionally, aligning under one policy may provide enhanced bargaining power for lower rates or additional benefits.

Improved Coverage Options

Family plans can provide broader networks and services, ensuring that both you and your spouse have access to top-notch healthcare facilities and specialists that might not be covered under individual plans.

Consulting with Insurance Experts

Though you might navigate insurance independently, consulting with an insurance agent or advisor can provide personalized insights. These professionals can help dissect complex policy details, ensuring the plan you choose aligns perfectly with your needs and budget.

Seek Guidance from a Broker

Employing a health insurance broker may offer an unbiased perspective on Blue Cross health insurance options. Brokers can clarify intricate policy details, advise on cost-saving measures, and ensure you select the most beneficial plan.

Utilize Online Resources

Many online tools and resources allow you to compare Blue Cross plans independently. These platforms can help clarify plan details, allowing you to visualize coverage changes and premium adjustments before committing.

Final Thoughts

Navigating health insurance changes, like adding a spouse to your Blue Cross plan, need not be overwhelming. By understanding your current plan, preparing necessary documentation, considering financial impacts, and seeking professional advice, you can make informed decisions that safeguard both your health and financial well-being. This guidance equips you to seamlessly integrate your spouse into your Blue Cross health insurance, ensuring peace of mind and robust coverage for both of you.