Filed under Disability Insurance on

How Disability Income Policies Protect Your Financial Future

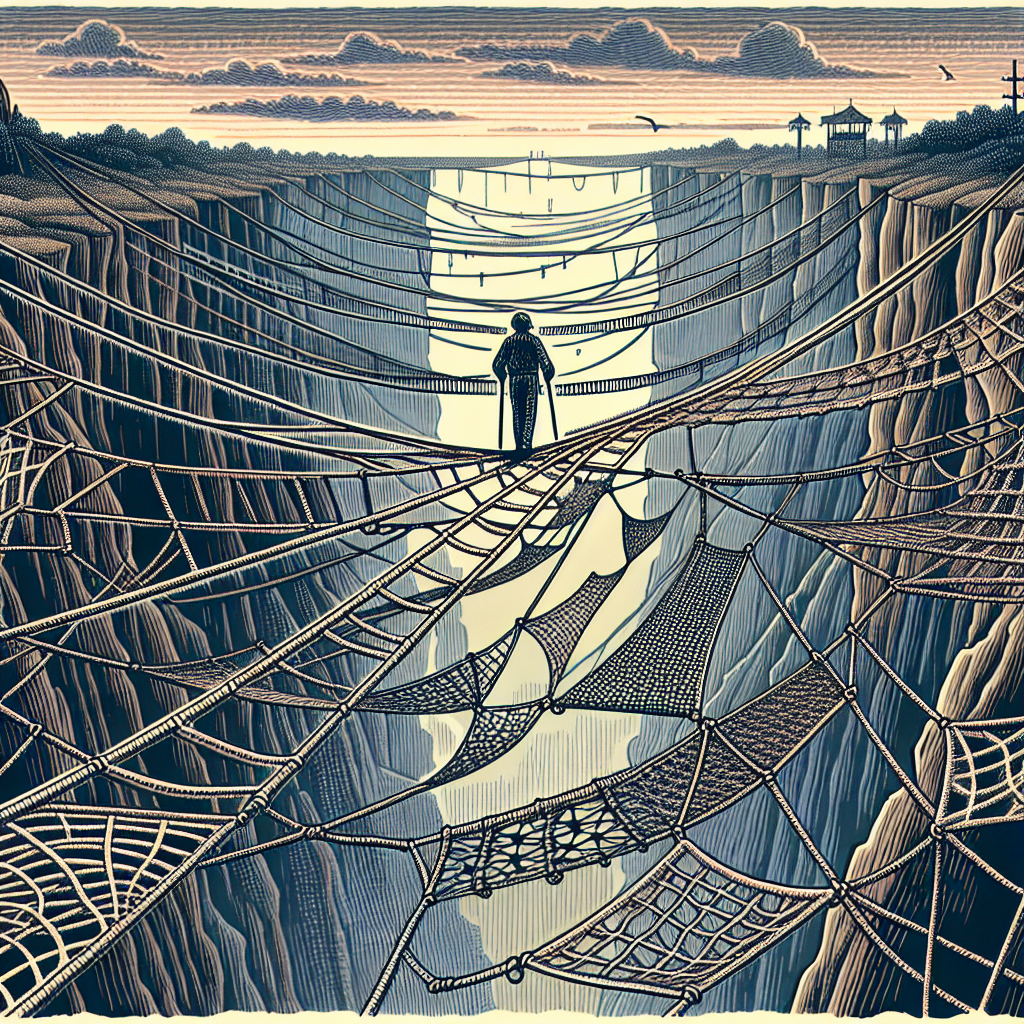

Disability income policies are more than just a financial safety net. They are pivotal instruments in safeguarding one's economic stability when faced with unexpected adversities. In a world brimming with uncertainties, understanding how these policies protect your financial future is essential. This comprehensive guide will delve into the nuances of disability income policies, articulating their importance, functionality, and how they serve as a linchpin in your financial planning strategy.

The Essence of Disability Income Policies

At its core, a disability income policy offers a lifeline, providing compensation in the form of income if you become unable to work due to a disability. These policies ensure continuity in your financial flow, mitigating the risk of depleting savings or incurring debt during periods of income loss due to health issues. This proactive financial measure ensures that life can continue with relative normality in the face of sudden changes.

Understanding the Mechanism

Disability income policies typically cover a portion of your usual salary, often between 50% to 70%, depending on the policy's specifics. The goal is to provide sufficient coverage so your current standard of living is maintained. Such policies can be short-term, offering immediate but brief support, or long-term, extending over several years or even until retirement. The breadth and depth of coverage vary across policies, necessitating careful selection based on individual needs.

How Disability Income Policies Protect Your Financial Future

1. Maintaining Lifestyle Stability

The primary benefit of disability income policies is maintaining financial stability, ensuring that monthly obligations such as mortgage, utilities, and groceries are met without significant lifestyle adjustments. By covering a substantial portion of lost income, these policies allow you to focus on recovery without the constant worry of financial turmoil.

2. Shielding Savings and Investments

Another critical aspect is the protection of savings and investments. Without disability income policies, you might be forced to dip into retirement funds, savings accounts, or liquidate investments to cover everyday expenses. Over time, such actions can severely compromise long-term financial goals and retirement planning.

3. Alleviating Financial Stress

Financial stress can be a significant burden during health crises. With a steady income stream from a disability income policy, you mitigate this stress, which can be instrumental in expediting recovery. The peace of mind provided by knowing that your financial future is protected allows you to concentrate solely on healing.

Choosing the Right Disability Income Policy

With numerous options on the market, selecting the most appropriate disability income policy can be daunting. Here are some expert tips to guide your decision-making process:

1. Evaluate Your Coverage Needs

Assess your current financial situation, including monthly expenses, savings, and any outstanding debts. This evaluation will help determine the amount of coverage you need to maintain your lifestyle if you become disabled.

2. Understand the Definitions and Exclusions

Familiarize yourself with the policy’s definitions of “disability” and scrutinize any exclusions. Some policies may limit coverage based on the type of disability or pre-existing conditions.

3. Compare Policy Features

- Benefit Period: Consider policies with benefit periods that align with your long-term financial goals.

- Waiting Period: Shorter waiting periods provide quicker access to funds but may increase premiums.

- Policy Renewability: Ensure the policy offers guaranteed renewability, safeguarding against sudden cancellations.

Industry Trends and Future Considerations

In recent years, there has been a noticeable shift towards personalized disability income policies that adapt to an individual's evolving life circumstances. The increasing integration of digital technologies in policy management also offers enhanced convenience and transparency.

Emerging Trends

Many insurers are now offering hybrid policies that combine disability income protection with other benefits, such as critical illness coverage. This trend reflects a growing consumer demand for comprehensive financial safety nets.

Expert Opinions

Financial planners consistently emphasize the critical role of disability income policies in a well-rounded financial plan. According to John A. Beckman, a certified financial advisor, “Incorporating a robust disability income policy is as essential as having a retirement savings plan. It’s not a luxury but a necessity.”

Conclusion

Disability income policies are instrumental in ensuring your financial future remains secure, even when faced with life's unpredictabilities. They do more than just replace lost income; they provide peace of mind, allowing you to navigate health challenges without added financial strain. As you take steps towards safeguarding your economic stability, consider how a well-chosen disability income policy can serve as a cornerstone of your financial resilience plan.

Whether exploring options or reassessing existing coverage, understanding the protective capabilities of disability income policies is an invaluable part of prudent financial planning. By acknowledging their importance and potential benefits, you empower yourself towards a more secure and predictable financial future.