Filed under Business Insurance on

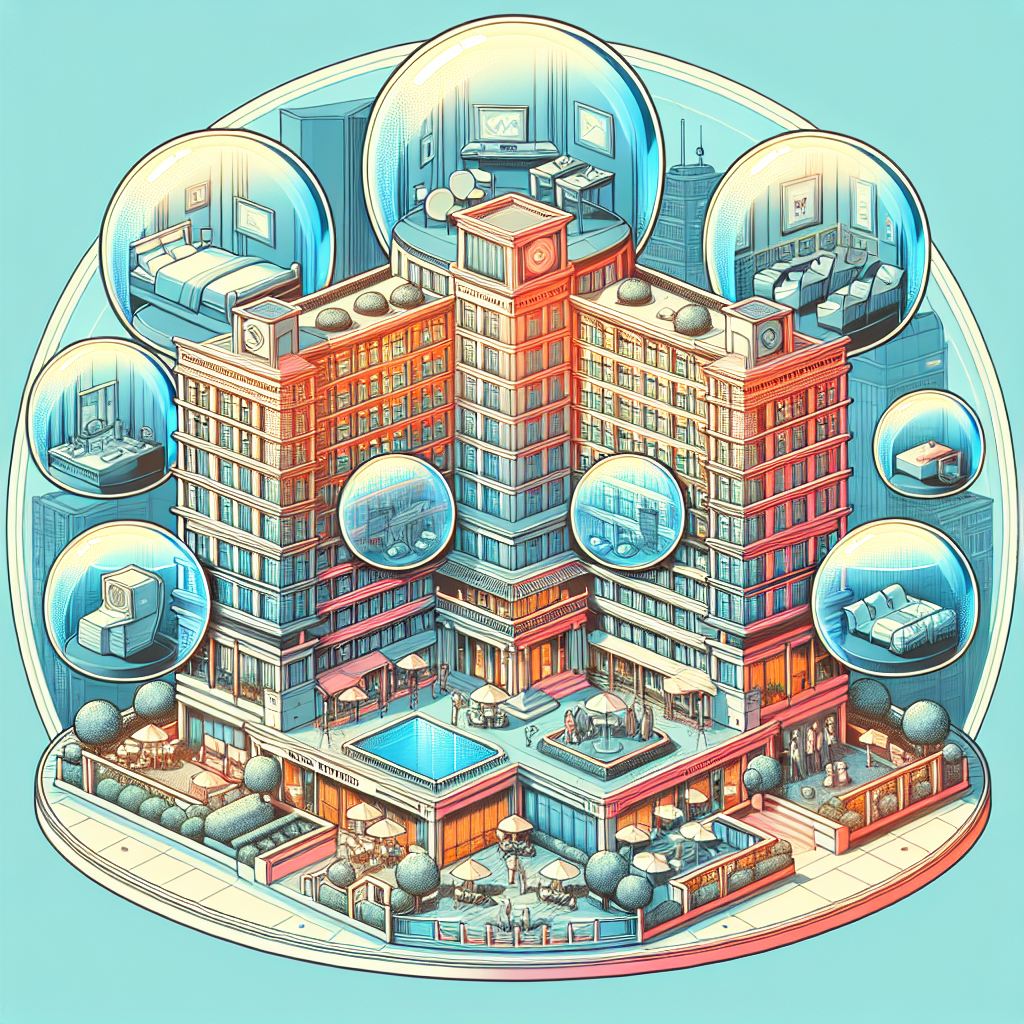

Essential Hotel Business Insurance: A Comprehensive Guide

Operating a hotel business comes with its unique set of challenges and risks. From ensuring the safety and comfort of your guests to managing employees and maintaining property, there's plenty to consider. One vital aspect that should never be overlooked is securing the right insurance. This comprehensive guide will delve into the essential hotel business insurance types that are indispensable for safeguarding your establishment against unexpected losses, providing peace of mind as you focus on delivering exceptional service to your guests.

Understanding the Importance of Hotel Business Insurance

Hotel business insurance is more than just a safeguard against potential threats; it's a strategic shield that ensures the long-term viability of your business. Running a hotel involves substantial investment, both in terms of capital and effort, and the right insurance coverage is critical in protecting these assets. A comprehensive insurance plan can help protect your hotel from various liabilities, ranging from property damage to employee-related claims and beyond.

Types of Essential Hotel Business Insurance

There are several types of hotel business insurance that you should consider to fully protect your establishment:

1. Property Insurance

At the heart of hotel business insurance is property insurance. This type of coverage is essential for protecting your hotel’s physical assets, including the building, furniture, equipment, and even landscaping. Property insurance covers damages resulting from events such as fire, theft, vandalism, and certain natural disasters. Investing in property insurance ensures you can quickly bounce back from damage without draining your financial reserves.

2. General Liability Insurance

General liability insurance is another cornerstone of hotel business insurance. This coverage protects your hotel against claims of bodily injury, personal injury, or property damage that might occur on your premises. For instance, if a guest slips by the poolside or an employee accidentally damages a guest’s belongings, general liability insurance can cover medical expenses and legal fees.

3. Business Interruption Insurance

Unforeseen events such as natural disasters, fires, or floods can temporarily halt hotel operations. Business interruption insurance provides compensation for lost income and operating expenses during such periods. This coverage is a critical component of hotel business insurance, allowing your business to stay afloat while you work to resume normal operations.

4. Workers' Compensation Insurance

With a significant number of employees often involved in running a hotel, workers' compensation is an essential part of hotel business insurance. It covers medical expenses, rehabilitation costs, and lost wages for employees who are injured on the job. This type of insurance not only helps protect your employees, but it also shields your business from lawsuits related to workplace injuries.

5. Liquor Liability Insurance

If your hotel includes a bar or hosts events where alcohol is served, liquor liability insurance is vital. This form of hotel business insurance covers claims involving alcohol-related accidents, such as a guest getting into an accident after leaving your hotel’s event. Having liquor liability coverage can prevent financial and legal repercussions and is often a legal requirement.

6. Cyber Liability Insurance

In the digital age, data breaches and cyber threats are a growing concern. Cyber liability insurance can protect your hotel from the fallout of cyber incidents, covering costs like legal fees, notification expenses, and even public relations efforts to repair your hotel's reputation. Including this in your hotel business insurance package is crucial as more transactions and reservations happen online.

7. Umbrella Insurance

Umbrella insurance is an extra layer of protection that extends your existing liability coverage. Because the hospitality industry is prone to various liability exposures, umbrella insurance ensures you are covered above the limits of your primary insurance policies. This safety net can be invaluable in extraordinary circumstances, providing additional peace of mind.

Factors Influencing Hotel Business Insurance Costs

While understanding the types of insurance is crucial, it's equally important to consider what influences the cost of hotel business insurance. Several factors may affect premiums, including:

- Location: Hotels in areas prone to natural disasters may experience higher premiums due to increased risks.

- Size and Value of Property: Larger hotels or those with higher property values require more coverage, thus affecting costs.

- Services Offered: Additional amenities like swimming pools or bars increase potential liabilities, impacting insurance costs.

- Claims History: A history of numerous claims can indicate higher risks, leading to increased premiums.

- Security and Safety Measures: Hotels with robust security systems and safety protocols may benefit from lower premiums.

Key Considerations When Choosing Hotel Business Insurance

Selecting the right hotel business insurance requires careful consideration of several factors. Here are a few key elements to keep in mind:

Comprehensive Coverage

Ensure that your policy offers comprehensive coverage that addresses the specific risks associated with your hotel. Work with an experienced broker familiar with the hospitality industry to identify potential gaps in coverage that could leave you vulnerable.

Tailored Policies

Every hotel is unique. Consider working with an insurer who can tailor policies to match your specific operational needs. A well-customized policy maximizes protection without overburdening you with unnecessary costs.

Understanding of Exclusions

Each insurance policy will have certain exclusions and limitations. It’s crucial to fully understand these exclusions to avoid surprises during a claim. Go over policy documents thoroughly and raise questions about unclear terms.

Financial Stability of the Insurer

The credibility and financial stability of the insurance provider are crucial. Choose a reputable company with a strong track record in the industry, ensuring they can cover claims when the need arises.

Trends and Expert Insights in Hotel Business Insurance

Keeping up with the latest industry trends and expert insights can help effectively manage risks and insurance costs:

- Focus on Cybersecurity: As hotels rely more on technology, enhancing cybersecurity measures is vital in reducing cyber-related claims.

- Sustainability Initiatives: Eco-friendly practices are not only attractive to guests but can also influence insurance premiums.

- Emphasis on Safety Protocols: Post-pandemic, hotels have implemented stricter health and safety protocols, which can positively impact insurance considerations.

Conclusion: Securing Your Hotel's Future

In the hospitality industry, preparation is invaluable. Investing in comprehensive hotel business insurance is crucial to shielding your establishment from unforeseen challenges. By carefully considering the necessary types of coverage and staying informed about industry trends, you can secure your hotel’s future, ensuring it continues to thrive amid uncertainties. Whether protecting your property from damage or dealing with liability claims, the right insurance coverage empowers you to focus on creating memorable guest experiences without concerns over potential risks.