Filed under Business Insurance on

Comprehensive Guide to Business Insurance in Honolulu

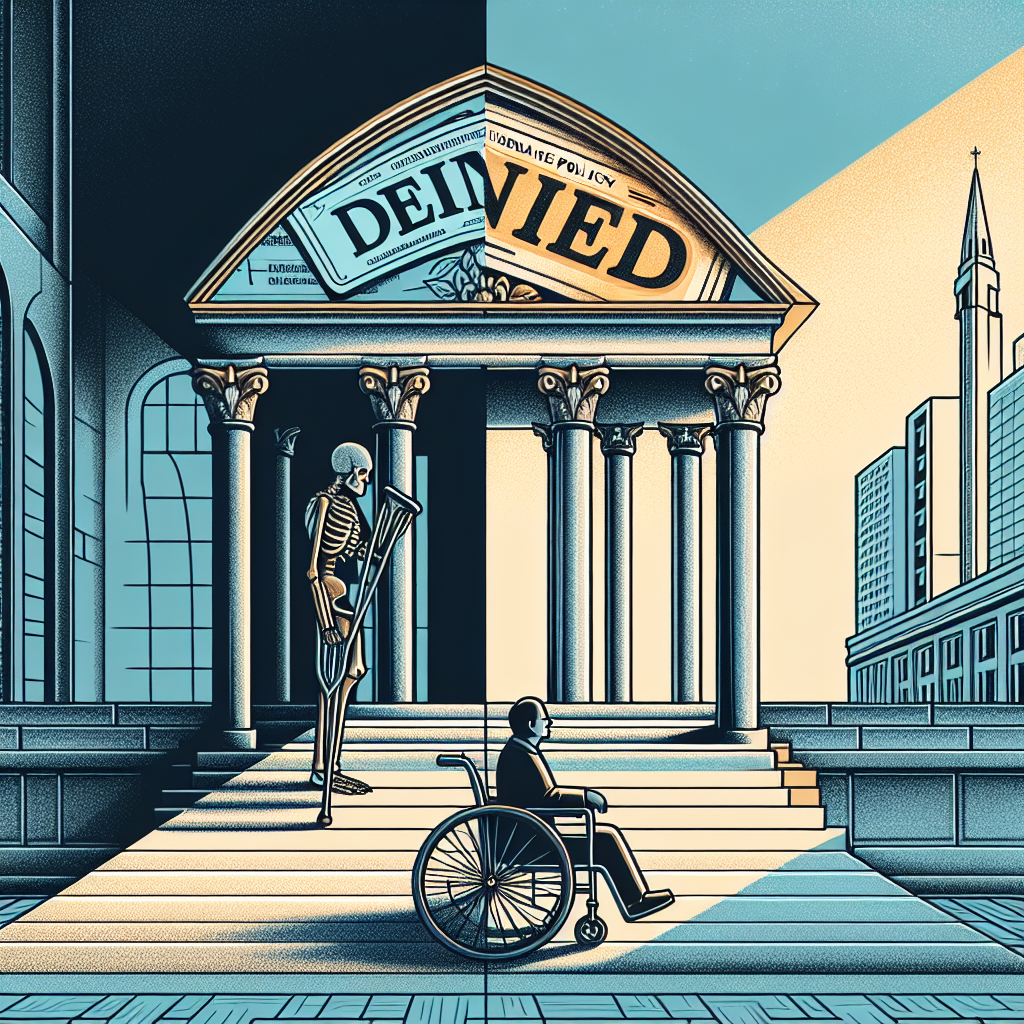

In the dynamic business environment of Honolulu, ensuring your enterprise is shielded from unforeseen risks is paramount. Business insurance serves as a protective shield, providing stability and continuity by mitigating potential financial setbacks. This comprehensive guide delves into the intricacies of business insurance in Honolulu, offering insights into its significance, types, and tips for selecting the right coverage for your unique needs.

Understanding Business Insurance

Business insurance is a crucial component for safeguarding your company against a variety of risks, including natural disasters, litigation, and operational interruptions. Its primary aim is to provide financial protection to businesses by covering potential liabilities that could arise during the course of regular operations. For any company operating in Honolulu, understanding the nuances of business insurance is more than a legal formality—it's an essential part of sustainable business strategy.

The Importance of Business Insurance in Honolulu

Honolulu's vibrant economic landscape encompasses a diverse mix of industries, from tourism and hospitality to technology and retail. This diversity comes with distinct challenges that necessitate comprehensive business insurance. For instance, natural disasters like hurricanes and floods are prevalent in Hawaii, necessitating robust coverage to protect physical assets and operational capabilities.

- Legal Compliance: In Honolulu, certain types of business insurance are mandated by law, such as workers' compensation insurance, which is necessary for compliance and protecting employees.

- Risk Mitigation: Every business, regardless of size, faces unique risks. Investing in business insurance ensures you have a cushion against financial losses, safeguarding your company's longevity.

Types of Business Insurance in Honolulu

Identifying the right type of coverage hinges on understanding the specific needs of your business. Here's a breakdown of prevalent business insurance policies in Honolulu:

General Liability Insurance

This essential coverage protects your business from third-party claims involving bodily injury, property damage, and advertising injury. Given Honolulu’s bustling tourist attractions and frequent business events, general liability insurance is indispensable for businesses of all sizes.

Commercial Property Insurance

This type of insurance safeguards the physical assets of your business, which is particularly vital in Honolulu, where natural events like tropical storms can potentially harm property. It covers damages to your building, equipment, and inventories, ensuring business continuity despite unexpected challenges.

Workers' Compensation Insurance

Workers' compensation insurance is mandatory in Honolulu for businesses with employees. It provides coverage for medical expenses and lost wages in the event an employee is injured or falls ill due to work-related activities. This insurance not only ensures compliance with local laws but also demonstrates a commitment to employee welfare.

Professional Liability Insurance

This coverage, also known as errors and omissions insurance, is critical for businesses that provide professional services. It protects against claims of negligence or mistakes that occur while performing duties. For Honolulu-based consultancies or legal firms, professional liability insurance is a valuable safeguard.

Business Interruption Insurance

In the event of a disaster or significant disruption, business interruption insurance provides necessary financial support to cover lost income and operational expenses. For Honolulu businesses, where natural calamities can disrupt normal operations, this type of insurance is a cornerstone of risk management.

Cyber Liability Insurance

As Honolulu’s businesses increasingly rely on digital tools and platforms, cyber liability insurance has become crucial. This coverage protects against data breaches and cyber threats, which can result in significant financial and reputational damage.

Selecting the Right Business Insurance in Honolulu

Choosing the right business insurance involves a strategic approach. Here are some steps to guide you:

Assess Your Risks

Begin by evaluating the specific risks associated with your industry and operations. A thorough risk assessment will help identify the necessary types of coverage and their appropriate limits.

Consult with an Insurance Expert

Engage with a local insurance broker or professional familiar with Honolulu’s regulatory environment and market dynamics. Their expertise can provide personalized recommendations, ensuring comprehensive coverage that aligns with your business objectives.

Compare Multiple Quotes

Obtaining quotes from different insurers is crucial. This comparison not only helps in acquiring cost-effective coverage but also ensures that the policies’ features serve your business needs adequately.

Understand Policy Details

Before committing, thoroughly understand what each policy covers, including exclusions and limitations. Awareness of these details prevents unexpected surprises when filing a claim.

Current Trends and Future Prospects in Business Insurance

In Honolulu, the insurance landscape is evolving, influenced by technological advancements and changing business practices. Here are some notable trends:

Increased Integration of Technology

The rise of InsurTech solutions is transforming how businesses purchase and manage insurance. Automated systems and digital platforms offer a streamlined experience, making it easier to customize policies to meet specific needs.

Focus on Sustainability

As environmental consciousness grows, insurers in Honolulu are offering policies that support sustainable practices, such as green building insurance. Businesses that integrate eco-friendly initiatives may benefit from reduced premiums and enhanced coverage options.

Enhanced Cyber Insurance

Given the increasing dependence on digital infrastructure, cyber insurance is experiencing growth. Policies are becoming more comprehensive, addressing not just data breaches but also potential system downtimes and reputational risks.

Conclusion

Business insurance in Honolulu is more than a safety net; it is a strategic imperatives that supports long-term growth and resilience. By understanding the diverse types of coverage and effectively assessing your business needs, you can make informed decisions that protect and empower your business against future uncertainties. Whether you are a burgeoning startup or an established enterprise, investing in business insurance is a prudent step towards securing your company’s future in the dynamic Hawaiian market.