Filed under Business Insurance on

Best Business Insurance Options in Scottsdale, AZ

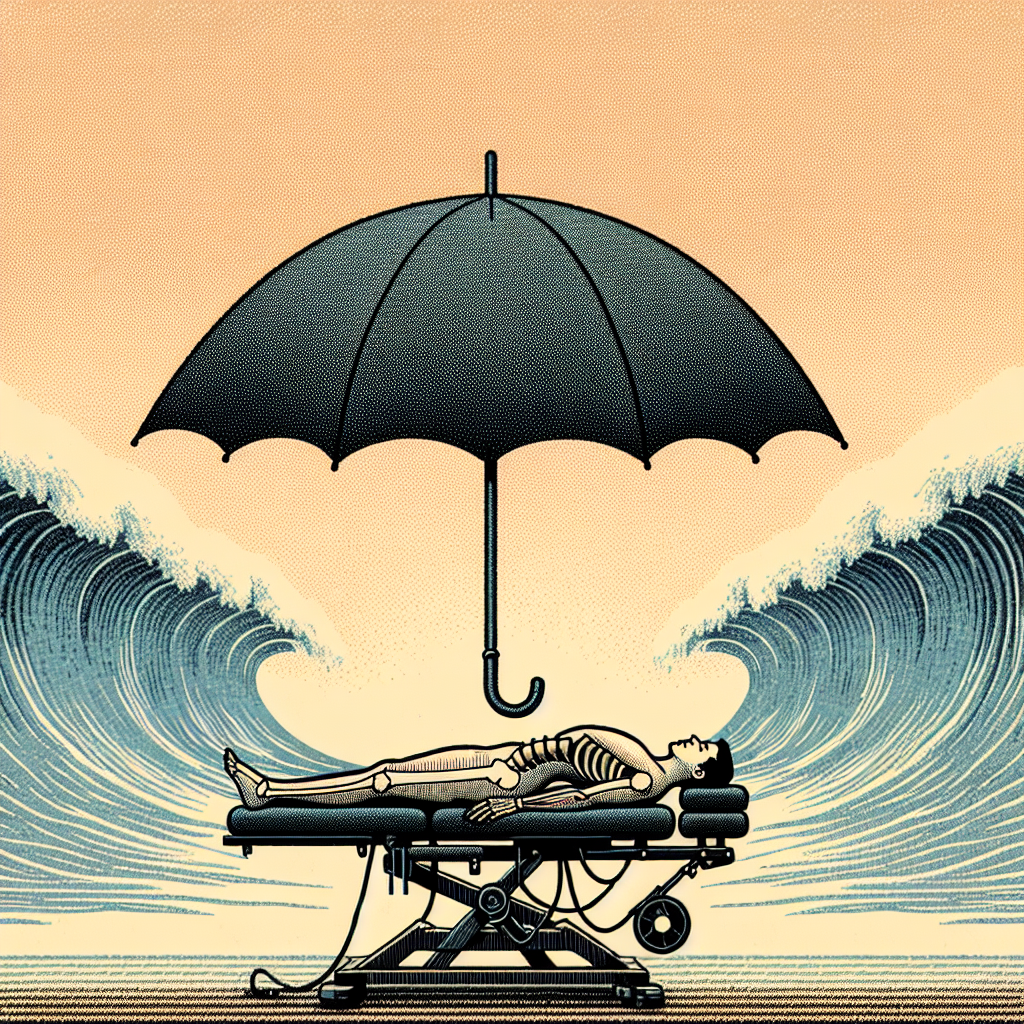

In the bustling business environment of Scottsdale, Arizona, having the right insurance coverage is not just a good idea—it's a necessity. Whether you're a startup, a small business, or a large corporation, securing the best business insurance options in Scottsdale, AZ, can protect your investment, employees, and future. This article explores the top insurance choices available for businesses in the area, helping you make an informed decision on what coverage is essential for your specific needs.

Understanding the Importance of Business Insurance

Business insurance is designed to safeguard your enterprise against potential risks and unforeseen events. From natural disasters and theft to lawsuits and employee injuries, appropriate coverage ensures that your business can weather unexpected challenges. In Scottsdale, where businesses are constantly evolving and industries are varied, having the right insurance is crucial to maintaining operational continuity and financial stability.

Types of Business Insurance Available in Scottsdale

To choose the best business insurance options in Scottsdale, AZ, it is essential to understand the various types of coverage available. Here's a breakdown of the most common insurance policies that businesses should consider:

General Liability Insurance

General liability insurance is a must-have for any business. It covers legal fees, medical expenses, and damages if your business is found liable for bodily injuries or property damage. In a city like Scottsdale, where customer interactions are frequent, this insurance is particularly important.

Commercial Property Insurance

Whether you own or lease your business space, commercial property insurance is vital. It protects the physical assets of your business, including buildings, equipment, and inventory, against losses due to fire, theft, vandalism, and certain weather-related damages. Scottsdale's dynamic climate makes this coverage particularly valuable.

Business Interruption Insurance

Unexpected events can disrupt your business operations significantly. Business interruption insurance compensates for lost income and covers operational costs if your business cannot function due to a covered peril. This is especially important for businesses in Scottsdale where weather-induced disruptions, like summer monsoon storms, can impact operations.

Professional Liability Insurance

Also known as errors and omissions insurance, this coverage is essential for businesses that provide professional services or advice. If a client claims that your negligence caused them financial harm, professional liability insurance helps cover the costs of legal defense and settlements. For Scottsdale's thriving professional services sector, including law firms, consultancies, and design studios, this insurance is indispensable.

Workers' Compensation Insurance

In Arizona, businesses with employees are typically required to carry workers' compensation insurance. This coverage provides benefits to workers injured on the job, covering medical expenses and lost wages. Ensuring you have this insurance in place protects both your employees and your business from potential lawsuits.

Specialized Insurance Options in Scottsdale

While the above policies are common across many businesses, some industries might require specialized coverage. Let's look at some niche insurance options worth considering:

Cyber Liability Insurance

In an age where data breaches and cyberattacks are prevalent, cyber liability insurance has become crucial. This coverage protects businesses from the costs associated with data breaches, including notification expenses, data recovery, and legal fees. Given Scottsdale’s vibrant tech scene, businesses in this sector should prioritize cyber insurance.

Product Liability Insurance

Manufacturers and retailers in Scottsdale may need product liability insurance to cover claims related to product defects. If a product you sell causes harm, this insurance will help cover legal fees and settlements, shielding your business from potentially crippling financial obligations.

Directors and Officers Insurance

This insurance is crucial for businesses with a board of directors. It protects the personal assets of directors and officers in the event they are sued for actions taken on behalf of the company. In Scottsdale, businesses of all sizes benefit from the security and peace of mind this coverage provides.

Factors to Consider When Choosing Business Insurance

Selecting the best business insurance options in Scottsdale, AZ, involves considering several critical factors:

- Industry Risks: Different industries face unique risks. Tailoring your coverage to your specific industry ensures comprehensive protection.

- Business Size: The size of your business can influence your insurance needs. Larger companies with more employees and assets typically require broader coverage.

- Location: Scottsdale's geographical and climatic conditions should influence your choice of insurance, as certain natural risks are more prevalent.

- Legal Requirements: Some insurance types are legally mandated. Ensure compliance to avoid hefty fines and legal complications.

- Financial Capacity: While it's crucial to have adequate coverage, balancing it with affordability helps maintain your business’s financial health.

Top Insurance Providers in Scottsdale

Scottsdale is home to numerous reputable insurance providers offering comprehensive business insurance solutions. Here are some of the top choices:

- State Farm: Known for its personalized service and extensive network, State Farm offers a range of business insurance products tailored to suit different industries.

- Nationwide: With a focus on small businesses, Nationwide provides customizable plans that cater to a variety of commercial needs.

- Farmers Insurance: Farmers is recognized for its competitive rates and comprehensive coverage options, making it a popular choice among Scottsdale businesses.

- The Hartford: Renowned for its expertise in commercial insurance, The Hartford offers specialized coverage options and excellent claims support.

- Liberty Mutual: Liberty Mutual provides robust business insurance solutions, including property, liability, and workers’ compensation coverage, tailored for various sectors.

Trends and Expert Insights

The business insurance landscape is continually evolving. Here are some key trends and insights from industry experts:

● Increasing Demand for Cyber Insurance: As cyber threats become more sophisticated, businesses are increasingly prioritizing cyber liability insurance. Scottsdale's tech businesses, in particular, are investing heavily in this area.

● Emphasis on Customization: Insurers are offering more customized insurance plans. Businesses are demanding flexible solutions that adequately cover their unique risks and dynamics.

● Integration of Technology: From AI-driven risk assessments to mobile app-based policy management, technology is playing a significant role in how business insurance is marketed, sold, and managed.

Conclusion

Securing the best business insurance options in Scottsdale, AZ, involves understanding your needs, evaluating risks, and exploring offerings from reputable providers. By choosing the right mix of coverage, you not only protect your business assets and employees but also ensure your company can thrive, even in the face of adversity. Stay informed about the latest industry trends, leverage expert insights, and consult with professional brokers to craft an insurance portfolio that delivers comprehensive protection and peace of mind for your enterprise.